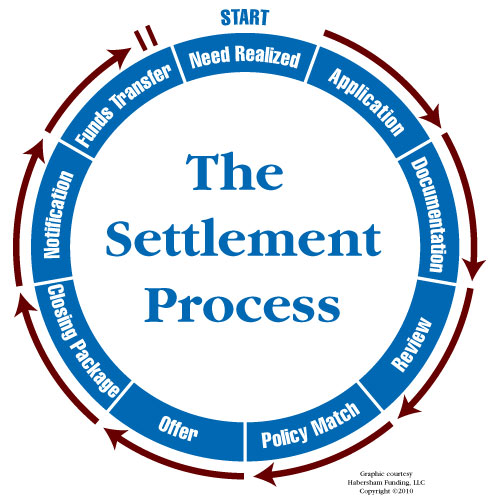

Our Settlement Forecast is a good first step toward determining if a policy qualifies for settlement. Once the decision has been made to pursue the option, a settlement application is completed. Completing an application does not obligate you to the transaction, and there is no application fee. The application allows Habersham Funding to assimilate the information needed to determine if your policy qualifies for sale and, if so, its value.

About qualifying policies

- Most types of individual life insurance policies (and many group policies) qualify for a settlement as long as they are at least $100,000 in face value and are at least two years old. These include virtually every policy type, including term, whole, universal, variable, group or joint survivorship.

- Policies may be owned individually, or through corporations, foundations, trusts, non-profit organizations or businesses.

- Once your policy is sold, you will no longer be responsible for paying premiums.

- The purchase price of a life policy is based on a number of variables including the age and health status of the insured, the face value and type of insurance, and the premium amount. The settlement you are offered depends on your individual circumstances.

- You will be asked various questions about your medical status and you will be asked to sign a release allowing the potential buyer of your policy to obtain and review your medical records for analysis.

Call one of our case managers toll-free for more information about the settlement process: 888-874-2402.